straight life policy develops cash value

Which statement is NOT true regarding a Straight Life policy. Which statement is NOT true regarding a Straight Life policy.

Porch Landscaping Ideas For Your Front Yard And More Porch Landscaping Front Yard Landscaping Front Yard Landscaping Design

The face value of the policy is paid to the.

. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Which statement is NOT true regarding a Straight Life policyA. The face value of.

Which statement is NOT true regarding a straight life policy. Toward the cost of actually insuring you. Which statement is NOT true regarding a Straight Life Policy.

Has the lowest annual. The term straight refers to the whole life insurance policys premium structure. The face value of the policy is paid to the.

Yearly Price Of Protection Method. Toward policy fees and changes. B An Accelerated policy.

A method used in actuarial analysis which is often used in the insurance industry. Dividends and Interest. When to buy a cash value life policy.

The rate of return will typically be large enough that. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Straight life insurance is more commonly known as whole life.

It usually develops cash value by the end of the third policy year. The face value of the policy is paid to the insured at age 100. In addition to a death benefit for your beneficiary and cash value for you straight life insurance offers a variety of benefits not found in other policies.

B Fees required by the company to provide the coverage and c Cash value which is an investment account associated with the life insurance policy. Which statement is NOT true regarding a Straight Life policy. Time in response to its growing cash value.

You can even cash in the surrender value of a life insurance policy. The face value of the policy is paid to the insured at age 100. The face value of the policy is paid to the insured at age.

The Yearly Price Of Protection Method is used to find out. Face value of policy is paid at age 100 B. The term straight life single-premium immediate annuity refers to the same thing.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. It has the lowest annual premium of the three types of. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

A straight life insurance policy can also build cash value over time. With cash value life insurance your premium payments go three places. A Limited-Pay Life policy has A.

Heres a look at the three options and why a policy loan is often the best solution. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

The total payout amounts depend on several factors including your life. It usually develops cash value by the end of the third policy year. Premium steadily decreases over time in response to its growing cash value.

This is a straight life annuity that starts paying you back as soon as you acquire it. Ten years later your policys cash value has grown to 750000. The gross amount of collections expected to be obtained through the liquidation of assets in an asset pool.

If a life insurance policy develops cash value faster than a seven-pay whole life contract it is a A Modified Endowment Contract. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole. The initial targeted cash value or.

How Much Does a Straight Life Annuity Pay Out. Usually develops cash value by end of third policy year C. However cash value policies can accrue.

The best way to use the cash value in your whole life insurance policy is through a policy loan. Premiums for cash value insurance policies can be significantly higher than for term life policies. Its premium steadily decreases over time in response to its growing cash value 2.

Into the cash value. As you are 65 years old now the cost of insuring your life is much higher. Initial Targeted Cash Value.

Executive Function Skills By Age What To Look For Life Skills Advocate

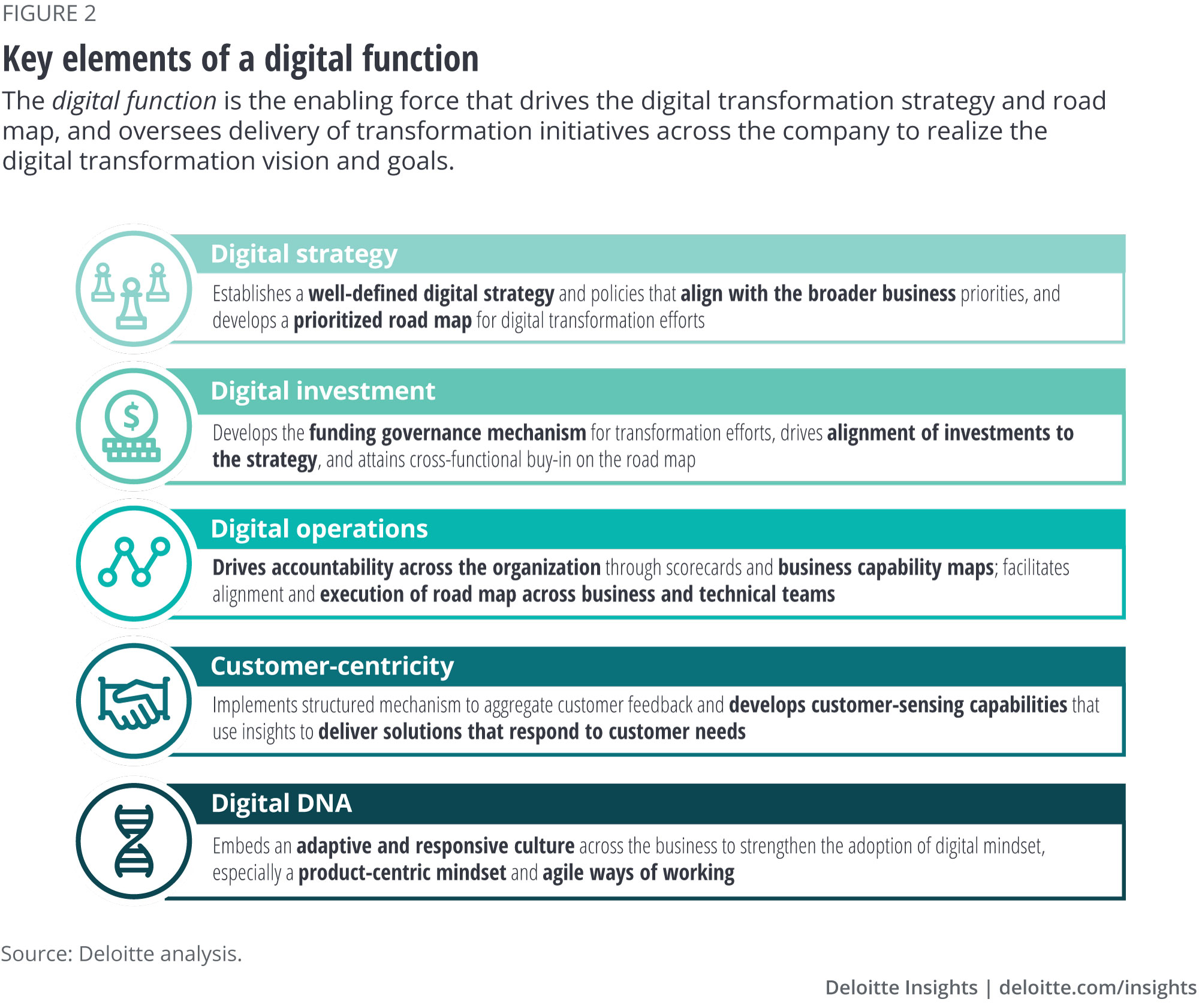

Industry Publications Technology Spotlight Scoping Considerations When Accounting For Software And Software Related Costs June 2020 Dart Deloitte Accounting Research Tool

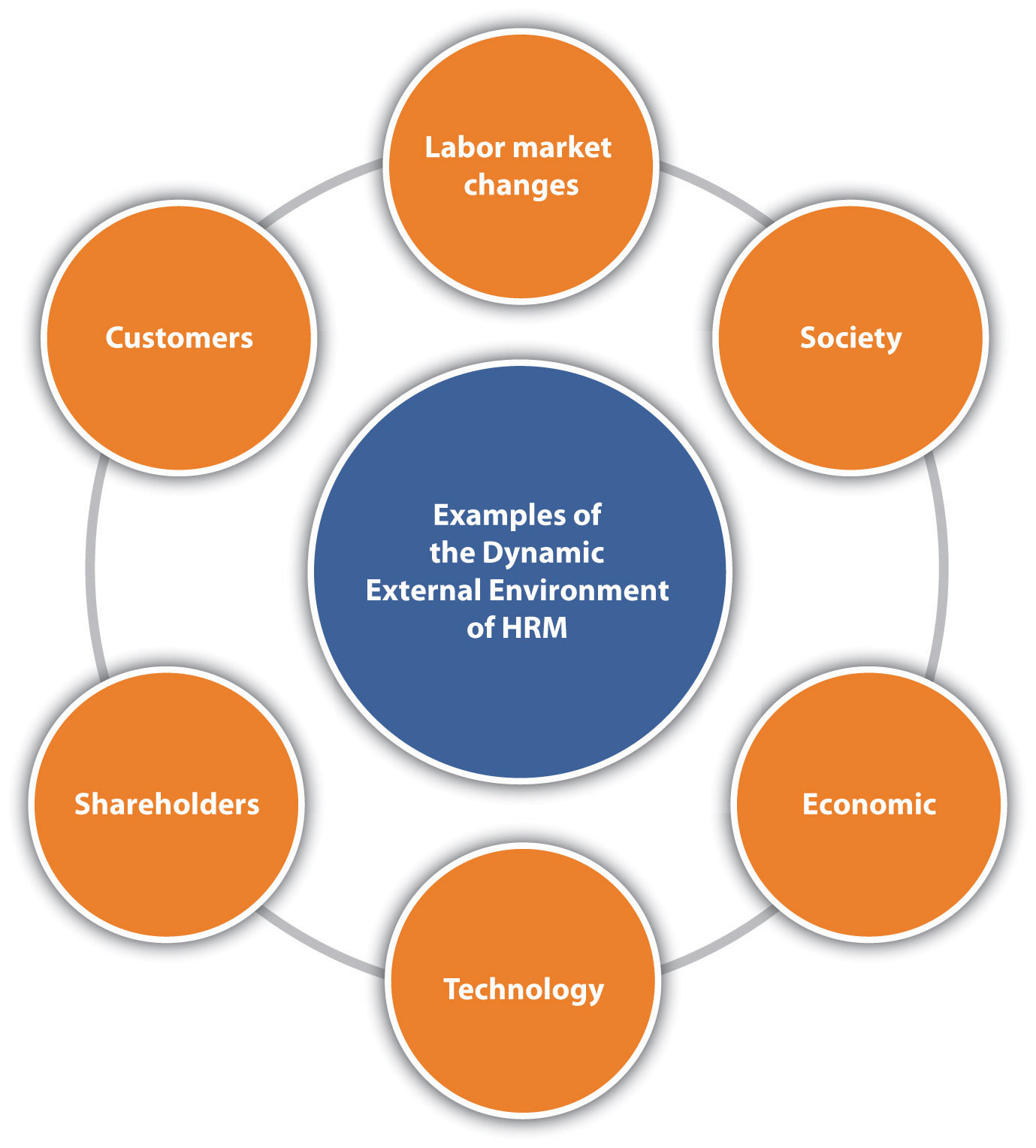

2 1 Strategic Planning Human Resource Management

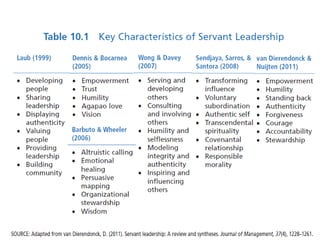

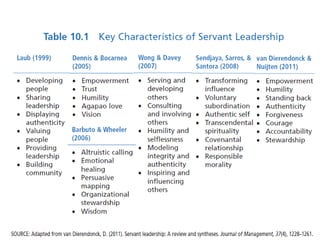

Servant Leadership Develops The Building Blocks For Successful Busin

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Software Testing Best Practices 11 Ways To Improve Testing Process Altexsoft

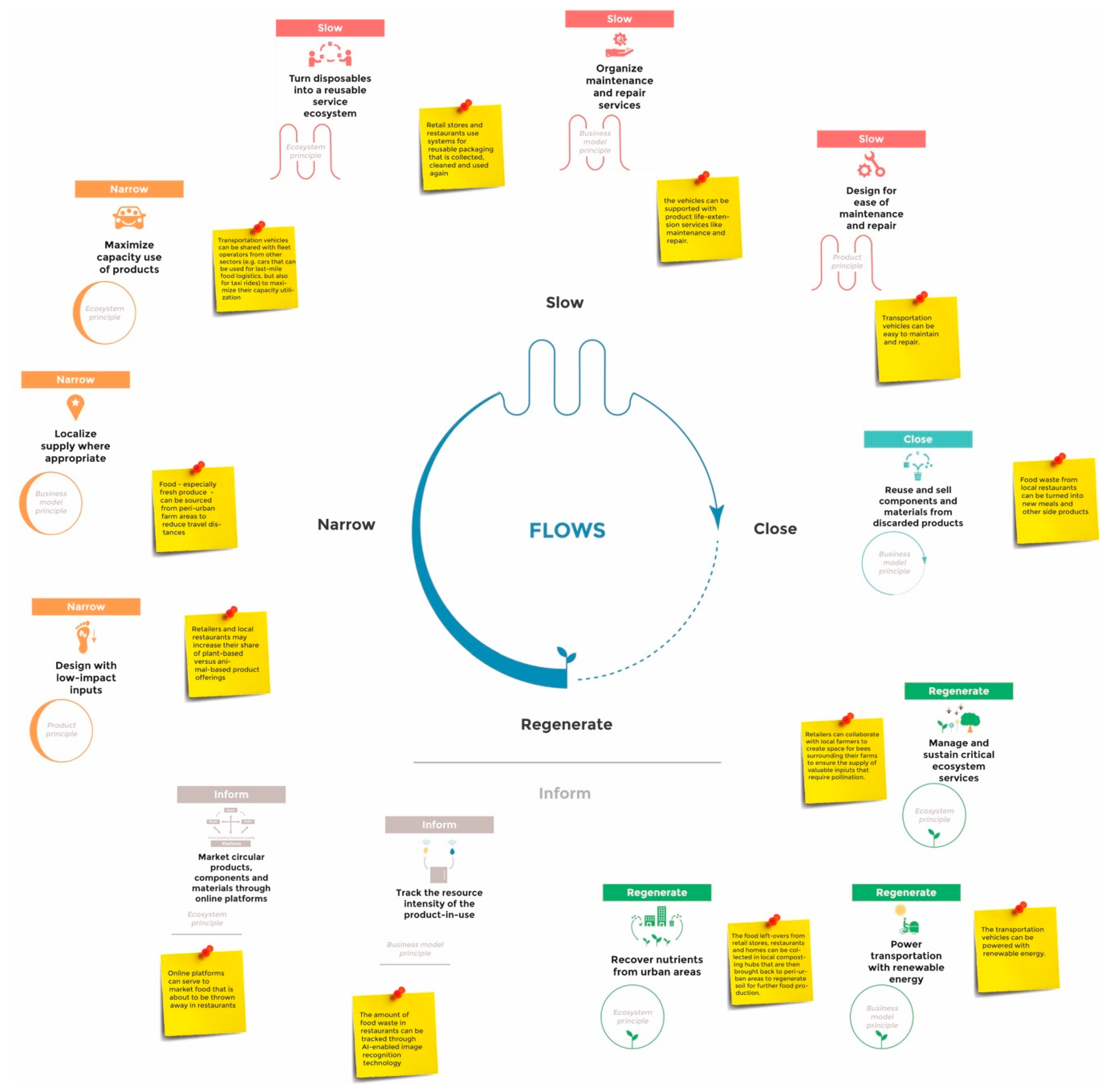

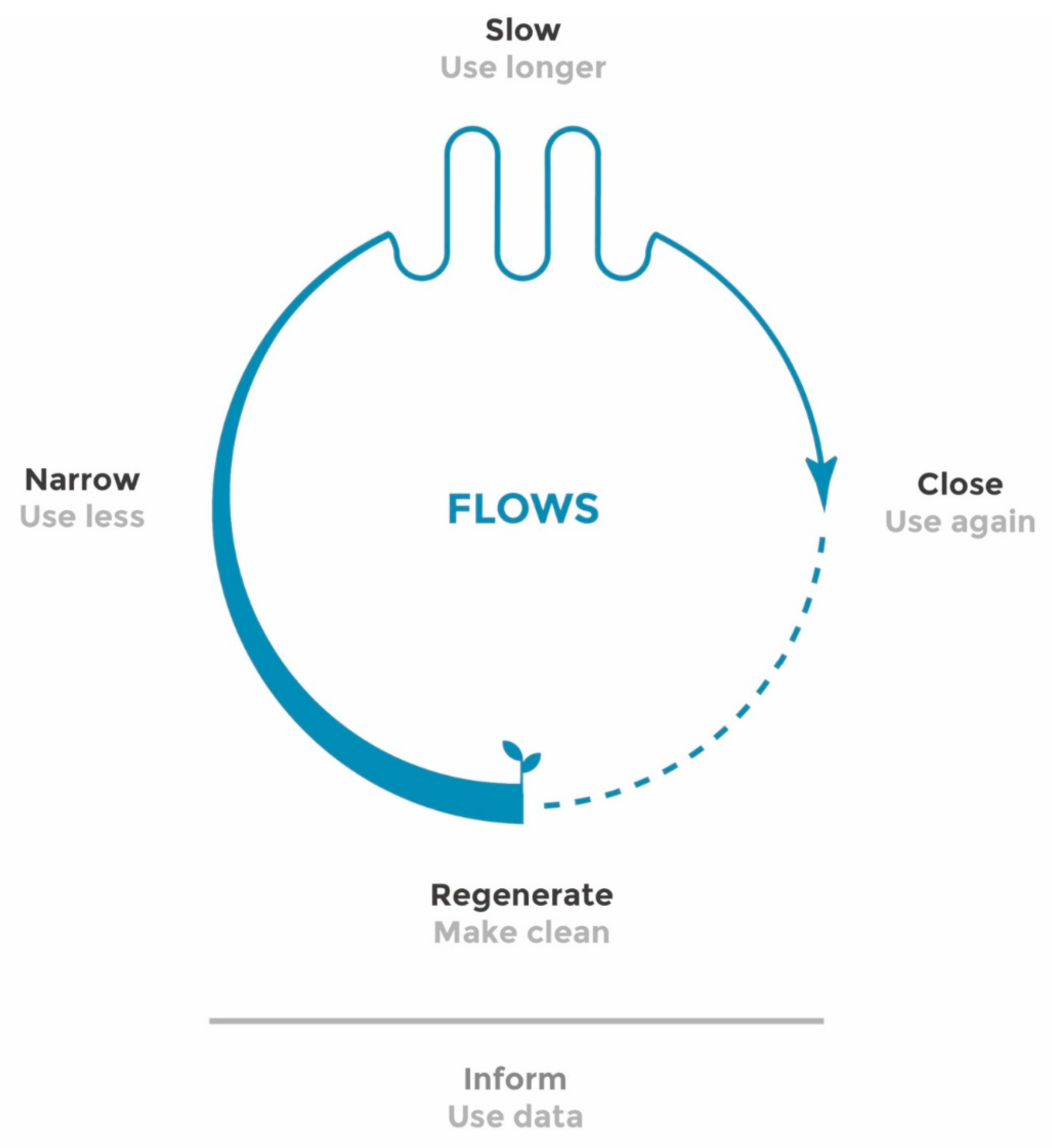

Sustainability Free Full Text A Tool To Analyze Ideate And Develop Circular Innovation Ecosystems Html

The Role Of Recognition In Disciplinary Identity For Girls Hughes 2021 Journal Of Research In Science Teaching Wiley Online Library

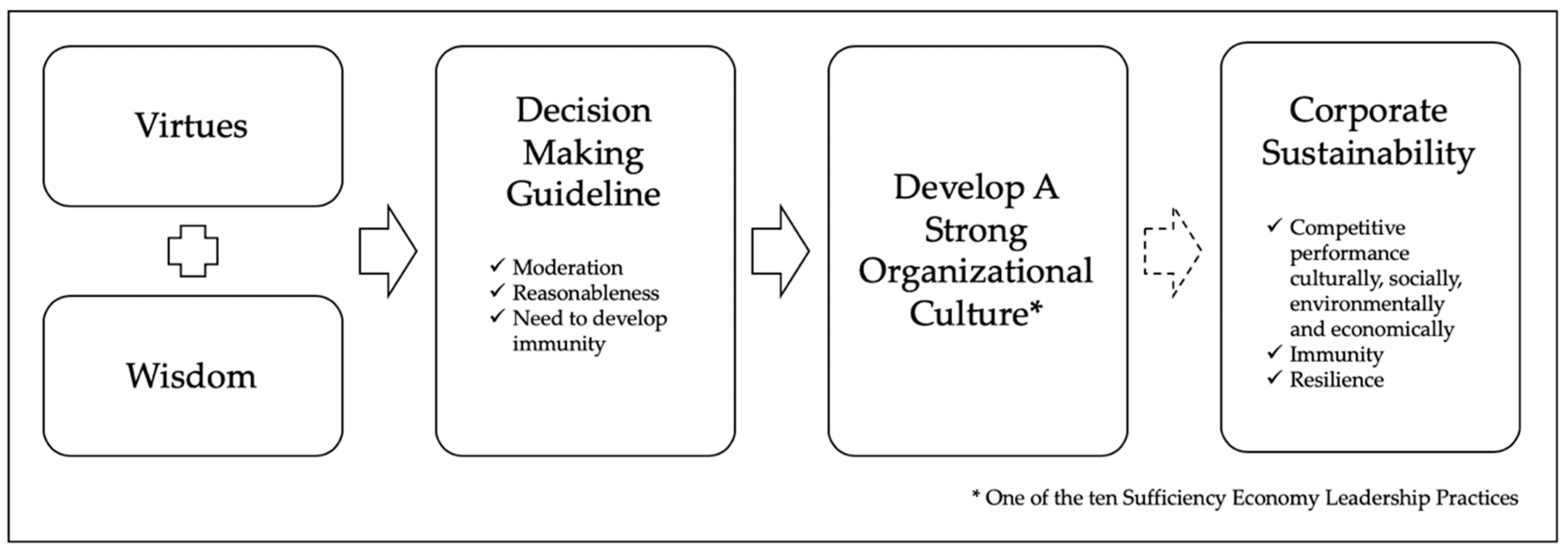

Sustainability Free Full Text Culture Development For Sustainable Smes Toward A Behavioral Theory Html

Servant Leadership Develops The Building Blocks For Successful Busin

The Myth About Leadership Vs Management Http Blog Xoombi Com The Myth About Leadership Vs Management Leadership Leadership Management Business Leadership

How Innovative Companies Train Their Employees

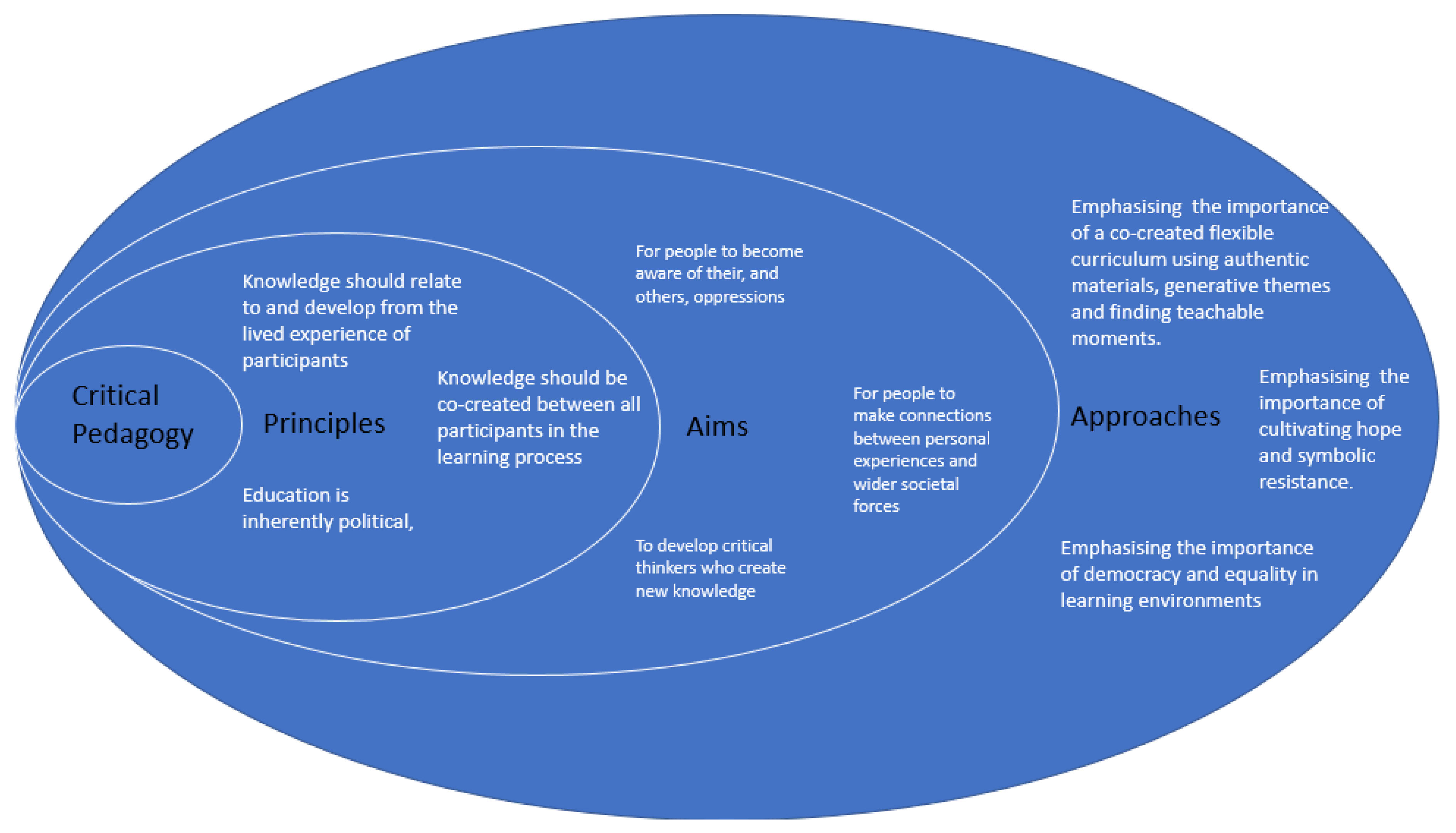

Education Sciences Free Full Text The Contested Terrain Of Critical Pedagogy And Teaching Informal Education In Higher Education Html

Sustainability Free Full Text A Tool To Analyze Ideate And Develop Circular Innovation Ecosystems Html